Acquisition Project - Aggregation platform for 20ft/40ft Freight Trailers

INDUSTRY USE CASE

India's ports act back bone for shipping 95% ( Source: Invest India ) of goods Volume into the country and outside the country. In this cargo, List of most shipped cargo is

- containerized cargo

- crude oil

- machineries and others

Due to Increased volume of trade & containerization of goods moving in ports, we see humongous vehicle traffic at ports sometimes waiting for days for loading and unloading of cargo from trailers. Lot of these trucks are operated by individual operators with demand coming from corporates.

Effectively ports operates as Hub for receiving cargo and Various spokes are roadways & railways bringing in cargo from other nodal points like Container Freight Station(CFS) & Inland Container Depots (ICD) and directly from factories.

these trucks are majorly owned by individual owners with less than 10 trucks . 85 % are fleet in owned such small fleet owners

PRODUCT

Product : Aggregation platform for container trailers built on ONDC network by placing booking directly by corporates

Industry : Freight Logistics-B2B ocean Freight

Product stage : PMF

Current Process :

Cargo movement is currently outsourced by factories to third party providers. these third parties are further involved with multiple intermediaries to reach the actual transporter. these intermediaries end up taking a cut from transporter's revenue who operate with a thin gross profit margin of 15-20%.

Core insight for the product is currently 2 to 2.5 intermediaries are there between truck operator and shipper

these intermediaries leads to Delay and improper communication to end customer ,sometimes causing delay in shipment and causing pain at critical situations thereby affecting TAT and operational efficiency of factories and trailers

Why This Product :

Benefits For Customers:

1.Reduce Intermediaries

2. Timely availability of vehicle for Shipment of Containers for Customers ( To Avoid Paying Additional Storage Charges.

3.Standardize shipment cost for distance travelled per unit weight

4.Bring uniformity and seamless movement to and from port/CFS in supply chain

5.Digitized Documenationa and live tracking with pre-informed Estimated time and date of Arrival

Benefits For Trailer Owners :

6.24/7 Dedicated call support

7.Resting Points for Driver Welfare & safe parking points with security

8.Road side assistance for vehicles ( to ensure they reach on time)

9.Improved cash flow by quick Payment after trip completion instead of 45-60 days

10.Instant Access to loads from 100s of reputed organizations live on ONDC

Intermediaries take upto 10% of revenue from truck operators

Focus : we are currently looking at demand side acquisition (end customers)

with assumption that supply side with be on board by discussion with various transport associations

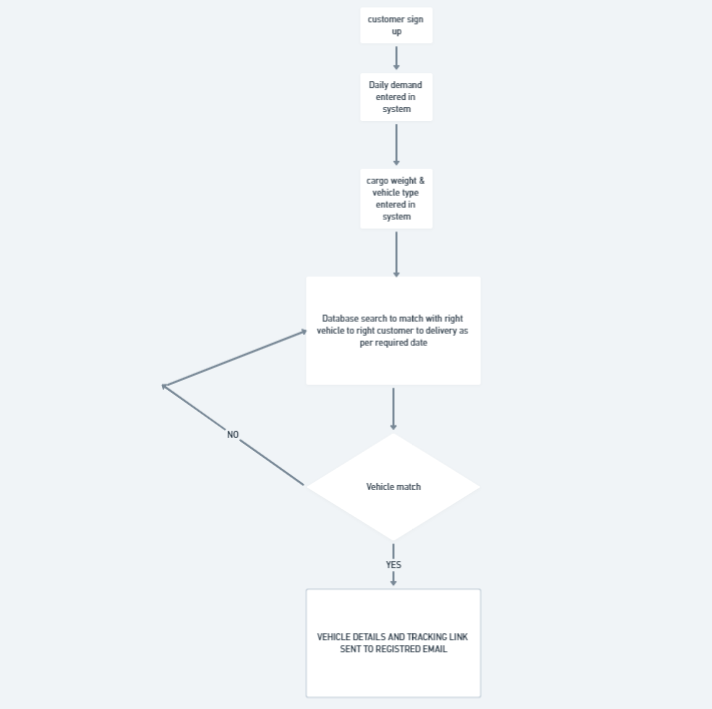

Proposed application flow for customer:

COMPETITION

This market is cluttered with mix. of organized and unorganized players

1. providing integrated services Such as Warehousing, Customs Clearance Documentation along with Transportation of Containers providing Customers a slew of services through mix of in-house & thirty party support.(Network & Fixed Contracts is the Moat) .Ex: kerry indev Logistics, Ceva logistics, Allcargo CFS

- Few Tech players are Building a platform by providing services in broad road transportation sector across various kinds of light Commercial vehicles (LCV) with little focus on port segment. most of vehicles on this platform are in less than 18MT segment in MCV . Ex: Let's transport, Trucknetic, Blackbuck, Vahak ( Data is moat with fixed contracts for recurring venue )

- Unorganized players : The dominant players in the market in terms of volume, but little in terms of capturing value created.( Roughly80%-market share, less than 10 Vehicles ) .this group supports the 1st and 2nd group during demand fluctuation

MARKET SIZE

INDUSTRY TAM:

Indian Logistics Industry is $300 Billion

Intercity road logistics is 75% is $225 Billion

In this Intra city Logistics is 8 % which is $ 18 Billion( less than 200 Km)

TAM For This Product:

To Calculate the TAM , we adopt the Top -Down Approach.

Here we take the ceiling of the business from publicly available data from investor reports of public companies(ex: Adani Ports ) and arrive at TAM and deduce to SAM,SOM

TAM= total Containers shipped to/From India per year * Average revenue per trip * Margin per trip

( 1 TEU = 1 twenty feet container)

| TAM |

|---|---|

Containers Handled in india last year* | 18million TEU |

avg. distance on road | 100km |

Average revenue per trip for 100 kms | Rs.15000 |

total revenue for 18M TEU is | 18M*15000=27000 crore |

commission charges @ 3% | 810 Crore |

*Data from Listed company's Investor communication letter

TAM =18M*15000* 0.03=810 Crore Revenue per year

TAM is 810Crore /year

Service Addressable Market :

SAM can be calculated by considering Share of Organized and unorganized business and Willingness to move away from traditional relationship based business to adopt Tech for this.

| SAM |

|---|---|

TAM | 810 CRORE |

*Assuming 40% organized business is held by intergrated Shipping Companies like MAERSK,CMACGM, MSC | 324 crore |

remaining businesses are | =810cr-324cr=486 Crore |

SAM Is 486 Crore/year

*Integrated Companies provide end to end solutions including cargo booking slots in ships, storage at warehouse, port services along with transportation. these customers are not ideal target for PMF stage as their needs are even bigger and we are Providing a limited offering now. so, they are not considered now for now during acquisition.

We have this opportunity to serve remaining Business with SOM of 486 Crore potential Revenue/year

Servicable Obtainable Market:

India has 13 major ports and 12 minor ports spread across 8 states and over 150+ Inland Container Depots in the hinterland.

As in PMF Stage, we are not active in all markets. we are focusing on one specific city in one state to find right fit before scaling.

so, we further narrow down market size to current geography where we are active in now

| SOM |

|---|---|

SAM | 486 CR |

80 % container traffic originates at 4 major cities(Chennai, mumbai, mundra, Kolkata) | =80% of 486=388cr |

Initial target city is Chennai (with 30 % share among the four) | 388*0.3=116 Cr |

Serviceable Obtainable Market is 116 Crore /year

ICP

Customer-ICP

| ICP 1 | ICP 2 | ICP3 | ICP4 | ICP 5 |

|---|---|---|---|---|---|

| Job title | Logistics Head | Customer success manager | CFS-Import/Export Head | Transportation Company-Owner | Transportation Manager-Integrated Supply chain |

| Age / Gender | 35-45 | 30-35 | 40-45 | 30-50 | 30-40 |

| Organisational Goals | Increase manufacturing/shorten inventory | Increase revenue from user-timely cargo movement | Increase utilization ratio of space | reduce vehicle idle time | increase contract value-diversify customer base |

Company Type | Manufacturing company(Ex:mfg of Steel,Glass) | Sea vessel Shipment company(Ex:MAERSK) | Container Storage and dispatch company to & from PORT(node in supply chain)(ex: allcargo,SATTVA CFS) | Pure Transportation Company | Integrated Supply chain Company(ex: kerry Indev,NTC Logistics) |

| Role Priorities | Timely delivery of material to plant | Ensure cargo in shipped timely to and from mentioned location without damage in material | Increase Revenue and capture more wallet share through additional services | Do planning of shipments according to Customer requirements on within mentioned period . | meet Company metrics and turn around time requirements with max.revenue to company |

| Role in buying process | end user-influencer | head of influencer | influencer | Decision maker | influencer |

| Reporting Structure | reports to Supply chain manager | reports to operations manager | reports to head-operations | owner | Divisonal Head |

| Preferred Channels | mail,whatsapp,web | web,inhouse apps | email,sap,cargoes | whatsapp,call | email,call, |

| Products used in workplace | call,Email | Email,call | call, face to face,text | call,whatsapp,face to face | email,call, |

| Where do they spend time | Youtube,gmail,prime | outlook,youtube,whatsapp | email,sharechat,google | facebook,whatsapp,youtube | amazon,myntra,primevideo,youtube,insta |

| Pain Points | Avoid Excess Charge for storage,timely delivery for factory | Coordination with mulitple Parties responsible for shipment like PORT staff,Custom clearance team,Tranport incharge | Timely Consolidation and movement of goods to their location or to customer location(depending on requirement) with smooth flow in operations.Ensure vendors move in and out timely coordinated to meet time commitments | Vehicle availability at all times, time Quote to new customers, Ensure Driver discipline during duty.timely payment of bills to him. | Ensure timely availbility of vehicles for multiple customers on same date. Rent vehicle from outside apart from owned vehicle to satisfy demand. Balance fluctuation without additional impact on revenue |

Priority (Money vs time) | time | time | Money | Money | Time |

Here we have identified the various Potential ICPs for the product

we use this ICPs and apply our framework For user selection depending on stage of product .

| ICP1 | ICP2 | ICP3 | ICP4 | ICP5 | |

|---|---|---|---|---|---|---|

Ability to pay | Medium | high | Low | low | medium | |

Frequency of use | Medium | high | high | medium | medium | |

TAM | Large | Large | medium | low | medium | |

Urgency | High | Medium | High | High | Medium | |

Distribution | High effort to scale | High | Proportionate Impact to scale | Impact medium for the effort | Low margin to scale |

Based on above analysis ,ICP-2 is shortlisted,

| ICP2 |

|---|---|

| Job title | Customer success manager |

| Age / Gender | 30-35 |

| Organisational Goals | Increase revenue from user-timely cargo movement |

Company Type | Sea vessel Shipment company(Ex:MAERSK) |

| Role Priorities | Ensure cargo in shipped timely to and from mentioned location without damage in material |

| Role in buying process | head of influencer |

| Reporting Structure | reports to operations manager |

| Preferred Channels | web,inhouse apps |

| Products used in workplace | Email,call |

| Where do they spend time | outlook,youtube,whatsapp |

| Pain Points | Coordination with mulitple Parties responsible for shipment like PORT staff,Custom clearance team,Tranport incharge |

Priority (Money vs time) | time |

CVP

Core value Proposition of the Product:

1.Book Trailers on-Demand from vast selection at your price point. (For Shippers)

2.Avail Direct Loads from reputed companies directly in ONDC, Reduce waiting time and Increase Profits.

3.Pay Transporters Early with Invoice Discounting Model (For Truckers).

4. Use Govt. Port data From Unified Logistics Interface Platform(ULIP) Portal to plan trips Timely reducing waiting time at ports

Stage : PMF

JTBD :

Functional: Ability to serve fluctuating demands

Financial : On-time Clearance , saving additional Cost on storage

Personal: Time Saved from frequent calls and follow ups with transportation companies

Social :

Primary job is to serve fluctuating customer demands

Channel Prioritization

For the Product , we do the Channel categorisation and arrive at few choices

Channel name | Cost | Fexibility | Effort | Lead time | Scale |

Founder Brand | Low | High | Low | Slow | Low |

Referral | Low | Medium | Low | Slow | Medium |

word of mouth spread | Low | High | High | Slow | Low |

Google search | High | High | High | High | High |

On the Ground sales team | Low | High | Medium | High | High |

Physical banner at strategic locations | Low | Low | Medium | Low | Low |

Google app campaigns | High | Low | High | Low | High |

Youtube | High | High | High | Low | High |

High | High | High | Low | High | |

SEO | medium | Medium | High | High | Medium |

As current Mode of contact for customers are mostly physical and through email and contact over call , Relying on heavy ad spends may be yield a highly positive outcome for this stage

we list down the various options to engage them and accustom to digital mode

Users can be accquired by | Hypothesis | |

|---|---|---|

linkedin Brand Awareness | Building trust by building brnad awareness by posting long form content and curating masterclass sessions with engaged community to introduce products | |

Database from EXIM BY category | Being part of EXIM Group and utilize the import/export database available to reach them via targeted email marketing | |

Exihibiting in events/expo | Top Warehousing expos/manufacturing expos are conducted by govt. ministries to boost opportunities. engaging with manufacturers and storage service providers in entry to organization | |

Connections through Industry body (ASSOCHAM) | Tie-up and involve in regional industrial body meetings and offer solutions | |

partnering with small scale regional freight-forwarders | Freight forwarders are one of the channel to connect and introduce to transportation services which can be accessed digitally | |

Product integrating with ocean carriers | Integrating our products and services with up in value chain. this brings in huge benefits of volume and revenue | |

publishing content in prominent shipping newsletter/providing guidance on trends | Engaging in logistic specific newletter which are wide read by management provide visibility of brand and services to upper management , thereby easy entry to organization by showing demo | |

loyality program | provide bonus miles for every 1000 miles shipped.this gives free trips for customers,incentivizing for usage of platforms and they comeback to utilize offering in a loop creating stickiness to product | |

driver as a acquisition channel to reach factories | Offering free benefits for long distance drivers like food and coupons for family outing provide sense of encouragement of current drivers to refer it across other tranporters during peak business helps sustain our operations demand.effectively serving customer and increasing revenue |

- leveraging founder brand by bringing organic traffic ( posting regular content about developments in logistics and customer impact stories,this increase organic traffic to website

- Referral ( good feedback from drivers -->reaching owners( through associations)--> these associations interactions with industry improving trust among peers to do digital across value chain

- utilizing stalls in logistics/Industrial events were we have maximum dense footfall across industries.showing demo of pro

Brand focused courses

Great brands aren't built on clicks. They're built on trust. Craft narratives that resonate, campaigns that stand out, and brands that last.

All courses

Master every lever of growth — from acquisition to retention, data to events. Pick a course, go deep, and apply it to your business right away.

Explore courses by GrowthX

Built by Leaders From Amazon, CRED, Zepto, Hindustan Unilever, Flipkart, paytm & more

Course

Advanced Growth Strategy

Core principles to distribution, user onboarding, retention & monetisation.

58 modules

21 hours

Course

Go to Market

Learn to implement lean, balanced & all out GTM strategies while getting stakeholder buy-in.

17 modules

1 hour

Course

Brand Led Growth

Design your brand wedge & implement it across every customer touchpoint.

15 modules

2 hours

Course

Event Led Growth

Design an end to end strategy to create events that drive revenue growth.

48 modules

1 hour

Course

Growth Model Design

Learn how to break down your North Star metric into actionable input levers and prioritise them.

9 modules

1 hour

Course

Building Growth Teams

Learn how to design your team blueprint, attract, hire & retain great talent

24 modules

1 hour

Course

Data Led Growth

Learn the science of RCA & experimentation design to drive real revenue impact.

12 modules

2 hours

Course

Email marketing

Learn how to set up email as a channel and build the 0 → 1 strategy for email marketing

12 modules

1 hour

Course

Partnership Led Growth

Design product integrations & channel partnerships to drive revenue impact.

27 modules

1 hour

Course

Tech for Growth

Learn to ship better products with engineering & take informed trade-offs.

14 modules

2 hours

Crack a new job or a promotion with ELEVATE

Designed for mid-senior & leadership roles across growth, product, marketing, strategy & business

Learning Resources

Browse 500+ case studies, articles & resources the learning resources that you won't find on the internet.

Patience—you’re about to be impressed.